1. If you received more than $10,000 in a single cash transaction or related transactions.

2. This form is required of basically anyone who receives over $10,000 in cash- individuals, businesses, associations, trusts, or estates.

3. Important to note that this period covers a rolling year.

Best practice is to simply collect AND remit form 8300 anytime you begin receiving cash from a customer. Unless you have an accounting department specifically keeping track of the thresholds, it may be very easy to unknowingly exceed the threshold amount and therefore be out of compliance.

4. Important to note that cash includes cashier’s checks, bank drafts, traveler’s checks, and money orders just under $10,000. So please note that receiving these forms of payments still require the Form 8300 to be filed.

5. The same methods of cash over $10,000 mentioned in item 4 do not need to be reported as FINCEN requires banks to report these by filing the FinCEN Currency Transaction Report (CTR)

Online Filing of Form 8300

Alternatively, you may file online by registering with the US Treasury Financial Crimes Enforcement Network.

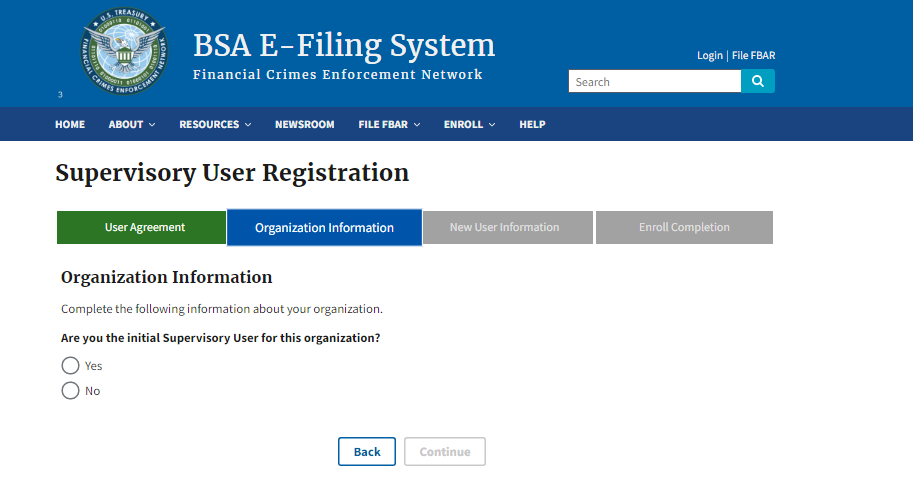

2. Terms must be accepted to proceed:

3. Continue to fill out the enrollment form

Penalties*

The penalties are extremely punitive for lack of adherence to filing Form 8300 either in paper form or via E File services.

*The IRS adjusts the penalty amounts annually for inflation. The following are the penalties rates for Forms 8300 due during the 2020 calendar year, on or after January 1, 2020.

Civil penalties and applicable rules are:

The penalty for negligent failure to timely file, to include all required information or to include correct information is $270 per return, not to exceed $3,339,000 per calendar year. IRC Section 6721(a)(1).

For persons with average annual gross receipts of not more than $5,000,000, the ceiling is $1,113,000. The penalty applies to each return. IRC Section 6721(d)(1)(A).

If any failure to file under IRC Section 6721(a) is corrected on or before the 30th day after the required filing date, the penalty is reduced to $50 in lieu of $270 and the maximum amount imposed shall not exceed $556,500 per calendar year. IRC Section 6721(b)(1). The ceiling is $194,500 for persons with average annual gross receipts of not more than $5,000,000. IRC Section 6721(d)(1)(B).

The penalty for intentional disregard of the requirement to timely file or to include all required information, or to include correct information is the greater of: (1) $27,820 or (2) the amount of cash received in the transaction, not to exceed $111,000 (with no calendar year limitation applicable). The penalty applies to each failure. IRC Section 6721(e)(2)(C).

The penalty for negligent failure to furnish a timely, complete, and correct notice to the person(s) required to be identified on the Form 8300 is $270 per statement, not to exceed $3,339,000 per calendar year. IRC Section 6722(a)(1). For persons with average annual gross receipts of not more than $5,000,000 the ceiling is $1,113,000. IRC Section 6722(d)(1)(A).

If any failure to furnish described in IRC 6722(a) is corrected within 30 days, the penalty is $50 in lieu of $270, and the ceiling is $556,000. IRC 6722(b)(1). For persons with gross receipts of not more than $5,000,000 the ceiling is $194,000. IRC 6722(d)(1)(B).

If any failure described in subsection (a)(2) is corrected after the 30th day referred to in paragraph (1) but on or before August 1 of the calendar year in which the required filing date occurs the penalty is $110 in lieu of $270, and the ceiling is $1,669,500. IRC 6722(b)(2). For persons with gross receipts of not more than $5,000,000 the ceiling is $556,500. IRC 6722(d)(1)(C).

Intentional disregard of the requirement to furnish timely, correct, and complete notices is $550 per failure or, if greater, 10 percent of the aggregate amounts of the items required to be reported correctly (with no calendar year limitation applicable). IRC Section 6722(e)(2)(A).

If you have missed these deadlines and can prove that you were not negligent and did not intentionally disregard the law, as mentioned above, you may be able to get penalties lowered.

Where to File Form 8300

Businesses can file Form 8300 electronically using the Bank Secrecy Act (BSA) Electronic Filing (E-Filing) System as mentioned above. This is an E-File service, so no documents will need to be mailed.

Alternatively, businesses can also mail the Form 8300 to the IRS at:

The Detroit Federal Building

P.O. Box 32621

Detroit, MI 48232

Summary

We know this may be an intimidating and even downright scary process. We’re here to support you so that you can be compliant and focus on growing your business – which is what you do best.

If you need assistance with completing the forms or registering online for an account, please contact our office, and we’ll be happy to guide you through the process. Compliance is key.

Helpful Links