Cannabis Tax Stacking Harms Legal Sellers and Drives Up Prices

Reprinted With The Permission Of Bloomberg Tax

ABFinWright’s Rachel Wright, Abraham Finberg, and Simon Menkes say Missouri’s two cases on cannabis “tax stacking” show how the practice drives consumers to the illicit marketplace.

Two cases in Missouri—one that is headed to court in May—seek to stop some counties from tax stacking a cannabis tax on top of one already being charged for city sales. These cases create a situation where cannabis companies and their customers are forced to pay far more taxes than what legislators originally intended.

Unfortunately, governments in cannabis-legal states have pushed through taxes that are burdensome. And in some cases, it’s impossible to comply unless the business comes out of its pocket and pays significantly more tax than it collects from its customers.

These government tax grabs have forced legal cannabis businesses to raise their prices to pay for the inflated taxes, making them less competitive and driving consumers to the illicit marketplace. Tax stacking also has reduced the amount of state and local taxes collected.

Amendment 3: Cannabis Tax Stacking in Missouri

Missouri’s Amendment 3 legalized adult-use cannabis sales on Nov. 8, 2022, authorizing an adult-use cannabis tax of 6% with the option for local governments to enact an additional cannabis tax of 3%.

This means a dispensary in a city that enacted its own cannabis tax would collect 3% from its customers and pay the funds to that city. A dispensary in an unincorporated area whose county had enacted a county cannabis tax would collect and pay that tax to the county.

Several Missouri counties have cities with 3% city cannabis taxes, but also have enacted their own 3% county cannabis tax. This means such city dispensaries collect 6% from their customers, not 3%. This creates a city and county set of “stacked” taxes.

In February 2023, the Missouri Department of Revenue clarified that “a city and a county cannot ‘stack’ the additional up to 3% local tax on recreational marijuana sales.”

Pushback from counties caused the DOR to backtrack later in the month, stating the guidance was “rescinded” and that “the Department will not advise municipalities or counties regarding the possibility of stacking.” Missouri’s state court system will now have to decide whether this case of tax stacking is unconstitutional.

Tax-on-Tax Creates Confusion

Missouri’s obvious tax stacking is only one example; 20 states nationwide have local cannabis excise taxes, which can come from a county, a municipality, or a special district.

In some cases, these taxes haven’t been coordinated between the different governments involved. This has created a condition of tax stacking called “tax-on-tax,” resulting in confusion and vastly inflated taxes.

The problem arises from the definition of gross receipts, the number on which most of the nation’s state and local cannabis taxes are based. Most governments define gross receipts as all monies collected from the sale of cannabis products, less the amount collected for state sales tax.

Some states, such as California and Michigan, include the local cannabis taxes a business has collected as part of the gross receipts on which they base their state cannabis excise tax, even though the business only collects the tax to be remitted to their city or county. This creates a situation where tax is compounded on tax or tax-on-tax, inflating the excise tax the state can collect.

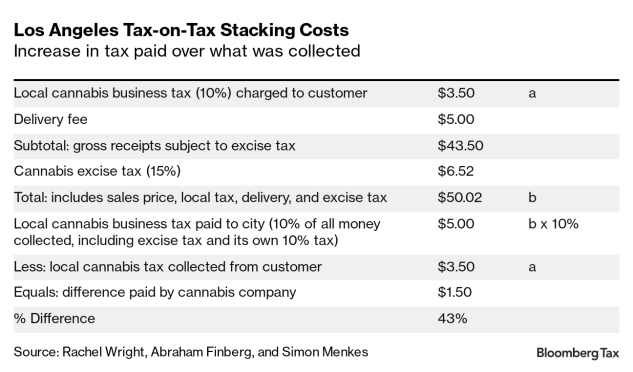

In California, some cities demand the state’s excise tax be part of their gross receipts calculation. The city of Los Angeles defines gross receipts as all money collected including the state’s excise tax. Only state sales tax is excluded. Los Angeles warns in its tax compliance guide that “reported gross receipts will be considered underreported if the business did not include in the gross receipts any excise taxes that was charged to the consumer.”

A Los Angeles cannabis company is therefore left with a conundrum: Does it include the state excise tax in its calculation of the city tax (as the city demands), or does it include the city tax in its calculation of the state excise tax (as the state demands)?

The only way to satisfy both parties is to pay the difference between the city tax it collects from its customers and the actual tax it pays to the city. In the case of cannabis businesses in the city of Los Angeles, this has resulted in a 43% increase in the tax paid over what was collected, as seen in the example below.

Cannabis Tax Stacking Has Major Economic Effects

Tax stacking-induced harm to the legal cannabis industry, its customers, and to state economies isn’t hard to spell out. The legal cannabis industry is already in a pitched battle with illegal sellers who pay no taxes whatsoever and who offer customers a low-priced (and less safe) option whose pricing legal sellers can’t match.

To place the additional burden of tax stacking on the backs of the legal cannabis industry is to make it that much harder to compete with illegal seller. Millions of dollars in business are driven to the shadow market, depriving states and localities of the legitimate tax dollars they deserve.

Studies have shown consumers are willing to pay no more than a 10% to 15% premium over the illicit market to purchase state-legal cannabis. Missouri’s tax stacking takes the state’s cannabis taxes from 9% (6% state, 3% local) to 12%, which is right within the threshold of taxation that will drive consumers to the illicit market.

State and local governments should avoid tax stacking at all costs—even if it means relinquishing the additional taxes they’ve managed to collect and would desperately like to keep.

More states and local governments should follow New Mexico, which formerly included excise tax collected as part of gross receipts when calculating its gross receipts tax but removed it from its calculation on July 1, 2023.

Struggling with the financial impact of tax stacking on your cannabis business? 420CPA is here to help you navigate tax complexities and implement a strategic plan to enhance your financial health. Contact us at info@420cpa.com to fortify your cannabis tax strategy.

Reprinted With The Permission Of Bloomberg Tax:

Note: This article does not necessarily reflect the opinion of Bloomberg Industry Group, Inc., the publisher of Bloomberg Law and Bloomberg Tax, or its owners.

Author Information

Rachel Wright, managing partner at AB FinWright, specializes in cannabis accounting and taxation for multi-state and multinational entities.

Abraham Finberg, managing partner at AB FinWright, has worked in the cannabis sector since 2009, counseling clients in business advisory and tax, from start-up through M&A and IPO.

Simon Menkes, CPA, supports AB FinWright’s clients and advisers through accounting and advisory services.