Cannabis Rates to Remain the Same on January 1, 2021

Source: CA Department of Tax and Fee Administration

Due to new legislation, Assembly Bill 1872 (Stats. 2020, ch. 93), the cannabis excise tax mark-up rate and the cultivation tax rates will not change on January 1, 2021.

Cannabis Excise Tax Mark-up Rate

The cannabis excise tax mark-up rate used by distributors to compute the average market price of cannabis or cannabis products sold or transferred to a cannabis retailer in an arm’s length transaction will remain at 80 percent for the period of January 1, 2021, through June 30, 2021.

The 15 percent cannabis excise tax is applied to the average market price of cannabis or cannabis products sold in a retail sale. The mark-up rate, currently set at 80 percent, is used when calculating the average market price to determine the cannabis excise tax due in an arm’s length transaction.

- In an arm’s length transaction, the average market price is the retailer’s wholesale cost of the cannabis or cannabis products plus the mark-up rate determined by the CDTFA.

- In a nonarm’s length transaction, the average market price is the cannabis retailer’s gross receipts from the retail sale of the cannabis or cannabis products.

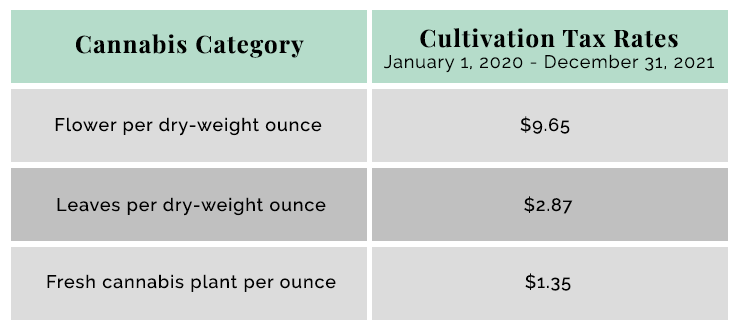

Cultivation Tax Rates

The cultivation tax rates for the 2020 calendar year will remain unchanged for the 2021 calendar year.

The CDTFA will adjust the cultivation tax rates annually for inflation beginning with the 2022 calendar year.

For current and prior cannabis mark-up and tax rates, see the CDTFA’s Special Taxes and Fees rate page, under Cannabis Taxes.