Blog

Reimagining the CPA Experience for Dynamic Business Growth

At 420 CPA powered by VERDANT Strategies, we don’t just crunch numbers; we craft tailored financial journeys. Here’s how 420 CPA is revolutionizing…

Calling all CANNABIS OPERATORS – AND ACTIVISTS

SAVE THE DATE: ****AUGUST 29, 10:00AM*** Calling all CANNABIS OPERATORS – AND ACTIVISTS STOP CALIFORNIA’S CANNABIS EXCISE TAX GRAB! …

Maximizing Your Impact at NECANN New Jersey: A Comprehensive Guide for Cannabis Professionals

Verdant Strategies-420CPA, in partnership with Beard Bros. Media, is gearing up for NECANN New Jersey. Scheduled for September 6-7, 2024, at the…

The Corporate Transparency Act – “It Ain’t Dead Yet!”

Still in Effect Experts warn hikers that injured rattlesnakes can pretend to be dead but will attack if a person approaches…

Understanding the Roles of CFO and Controller in Your Business Lifecycle

As your business grows and evolves, understanding the financial leadership roles of a Chief Financial Officer (CFO) and a Controller can be…

Maximizing Your Cannabis Conference Experience in 2024: A Guide from Rachel Wright, CPA

As the leisurely pace of summer vacations winds down, the buzz of Q3 and Q4 conference planning is ramping up. At 420…

NY Cannabis Excise Tax Good for Many, But Small Firms Lose Out

New York state cannabis businesses are now subject to a 9% excise tax, effective this month. The state’s move to an excise tax from…

Cannabis, Hemp And THC: Psychoactive Hemp Gains Ground As States And Others Push Back — Part 2

Part 1 of this 2-part series on Cannabis and Hemp examined the growth of psychoactive hemp and how it has put an…

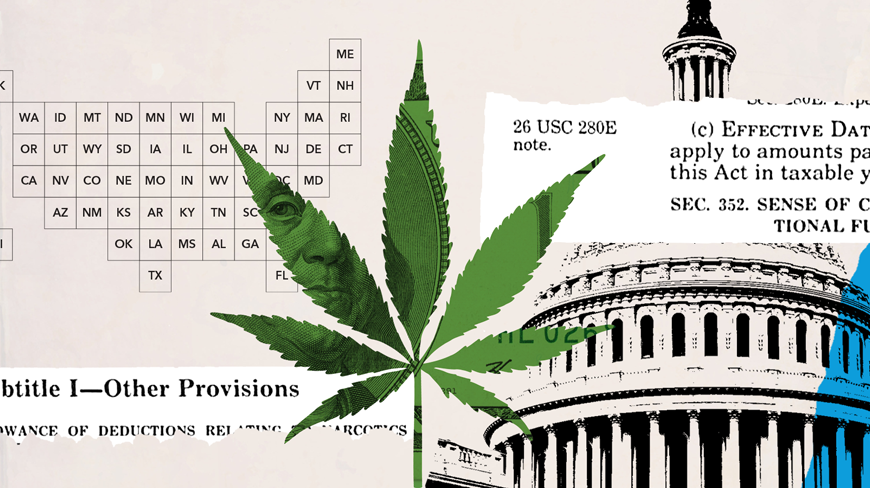

Cannabis Reclassification Would Trim Tax Burden, But Not Quickly

Reprinted with permission of Bloomberg Tax The Drug Enforcement Administration recommended that cannabis be transferred from its status as a Schedule I controlled substance…